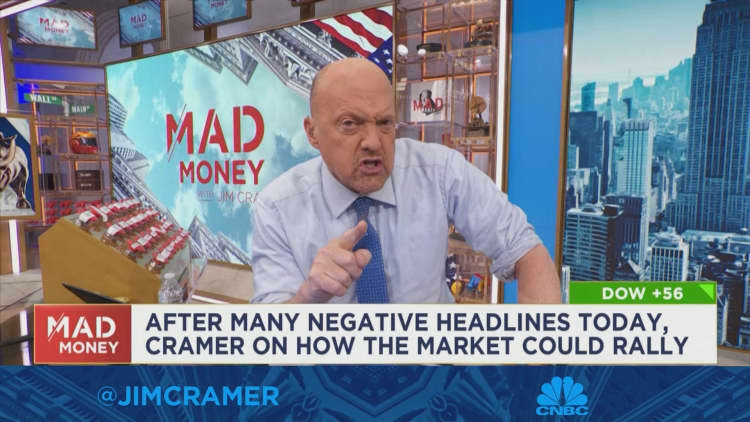

CNBC’s Jim Cramer said on Tuesday that he believes the Fed can be able to rein in inflation without tipping the economy into recession.

“If we can see an end to the buying spree…that is very positive for stocks. And it helps that we finally get to the kinks in the supply chain that are causing shortages everywhere. Put it all together, and there is a real possibility the Fed could actually Engineering that legendary downturn of the economy.”

Stocks rose on Tuesday after producer price index data for October indicated that inflation was declining, just a week after a softer-than-expected CPI report spurred a rally.

Referring to the Associated Press report, Cramer said: Russian missiles crossed into Polandand the collapse of FTX cryptocurrency and uncertainty about the outcome of the US midterm elections as examples.

In addition to market resilience, he added, retailers will likely have to offload their inventory at lower prices last month, which could lead to another deflationary winds. Retail sales data for October is due on Wednesday.

“That’s good for firstcool for TJX … Great for the consumer, amazing for the Federal Reserve, and therefore perfect for investors. “Ultimate Evil is a good Christmas story,” he said.

Disclaimer: Cramer’s Charitable Trust owns shares in TJX companies.

“Twitteraholic. Total bacon fan. Explorer. Typical social media practitioner. Beer maven. Web aficionado.”