An analyst who correctly described Bitcoin’s collapse this year warns BTC Owners, saying a cryptocurrency capitulation to King is on the horizon.

The pseudonymous analyst known in the industry as Capo tells his 692,200 Twitter followers that Bitcoin continues to show signs of weakness.

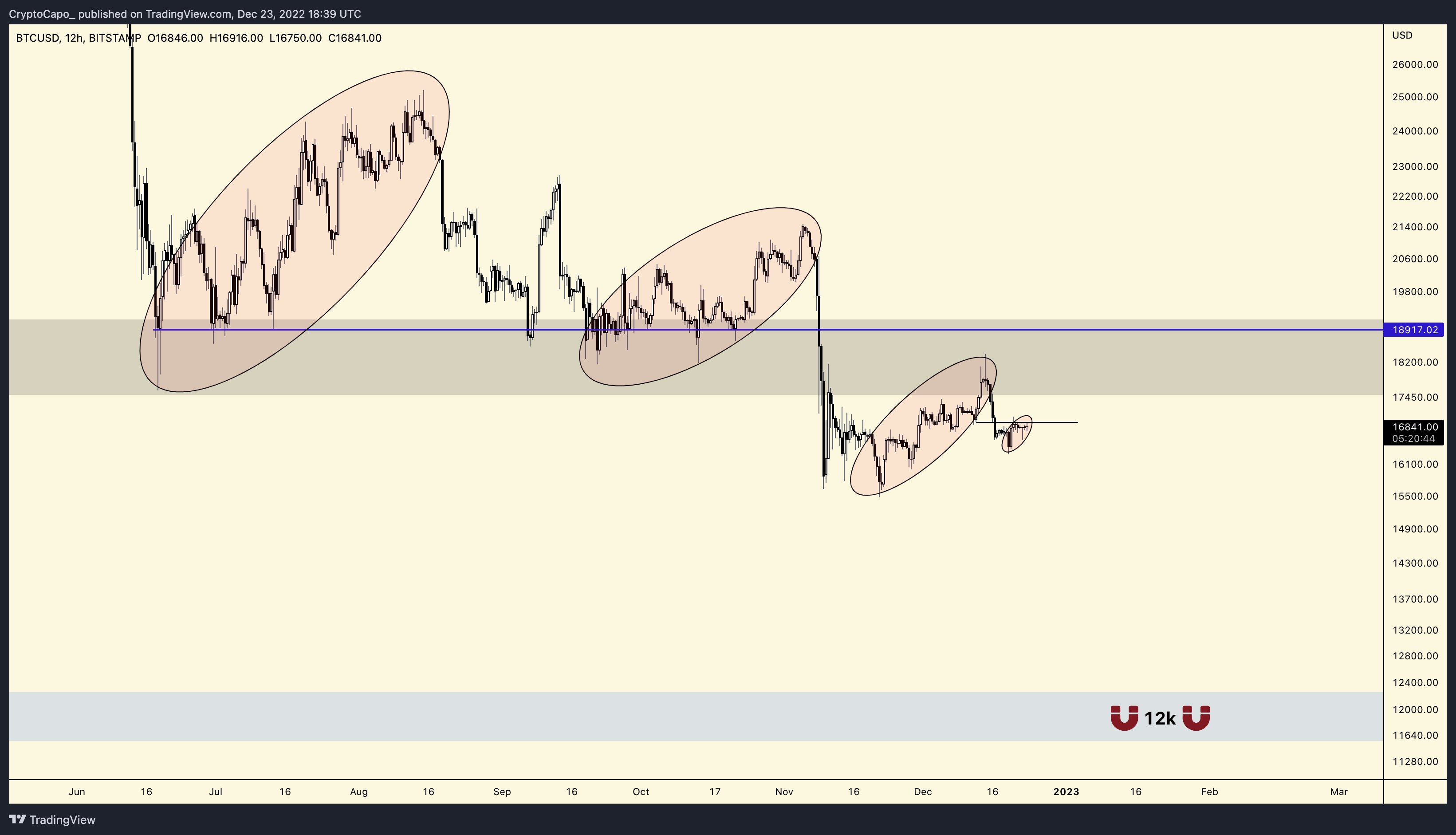

While the Bitcoin bulls managed to spark a rally from the current bear market low around $15,700, Capo says the recent bounce is noticeably smaller compared to Bitcoin’s previous highs since June.

“Every jump is smaller. Lower lows and lower highs. Support becomes resistance. $12,000 is like a magnet.”

At the time of writing, Bitcoin has changed hands for $16,840. A move to Capo’s target of $12,000 indicates a 28% drop in Crypto King.

Capo too He says It is possible that traders are not ready for a bearish move to the downside.

“Just read the comments here and you get a second confirmation (the first being analysis and indicators) that most people are trapped above $17,000 or more and can’t afford another drop. Like I said before, most people are just not ready for what’s coming and it shows.”

he is Add The current trading environment in cryptocurrencies and the stock market seems to be creating an “ideal scenario for a suitable capitulation.”

“The stock market is bleeding, altcoins are breaking key support, indices are pointing lower, and the bulls are euphoric about small pumps.”

Looking at the stock market, Capo says the S&P 500 (SPX) is still in a downtrend after honoring diagonal resistance.

“A clear bearish retest. The downside is intact.”

Traders are watching the performance of the SPX as a weak indicator indicates that investors remain wary of riskier assets such as stocks and cryptocurrencies.

Don’t miss out – Subscription Get encrypted email alerts delivered straight to your inbox

check price action

Follow us TwitterAnd the Facebook And the cable

browse Daily Huddle Mix

& nbsp

Disclaimer: The opinions expressed on The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in bitcoin, cryptocurrency, or digital assets. Please be aware that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend buying or selling any cryptocurrency or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl engages in affiliate marketing.

Featured image: Shutterstock / Roman Sakhno

“Twitteraholic. Total bacon fan. Explorer. Typical social media practitioner. Beer maven. Web aficionado.”